In today’s increasingly competitive real estate market, understanding the appraisal process cannot be overstated. Appraisals are required for all real estate transactions with loans involving $250,000 or more from federally-insured financial institutions, which impacts millions of Americans. Although appraisals are one of the most important parts of the home-buying process, they are often one of the most misunderstood.

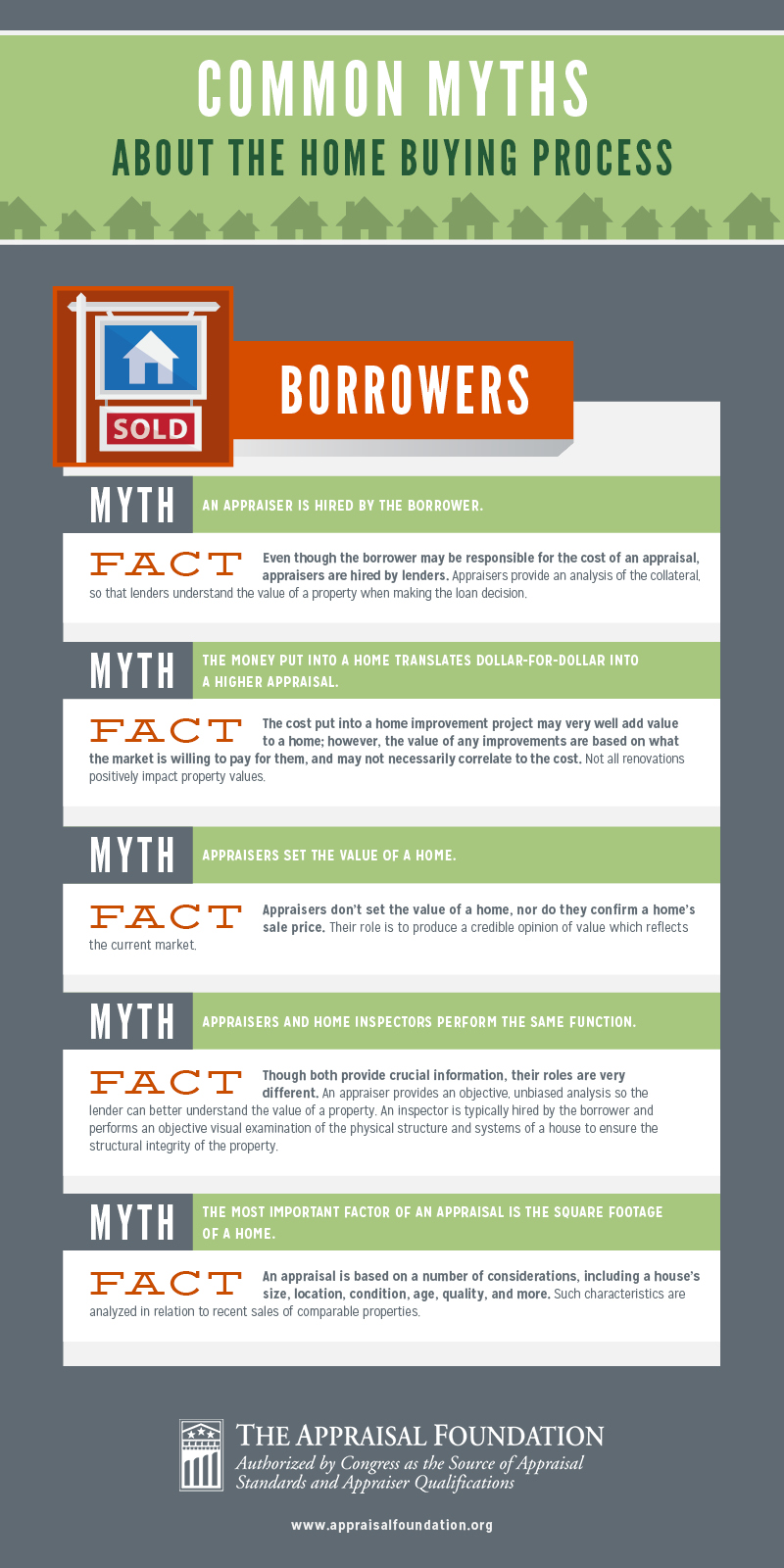

Contrary to some beliefs, appraisers neither set the value of a home nor confirm a home’s sale price. Their role is to produce a credible opinion of value based on thorough and unbiased research and analyses that reflect the market value of a property, which is not always the sale price. In many cases, an appraisal may help prevent a buyer from overpaying for a home. That’s why it’s so important to understand how an appraisal works and what they’re intended to do.

We at The Appraisal Foundation hear a lot of myths about the appraisal process — from people who are new to the home-buying process and from those who work in real estate professionally — but the most common myths out there relate to the way appraisals are ordered, role appraisers play in the home-buying process and the ways in which properties are analyzed and reviewed. Read more…

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link