Image: Coldwell Banker Brandsrv

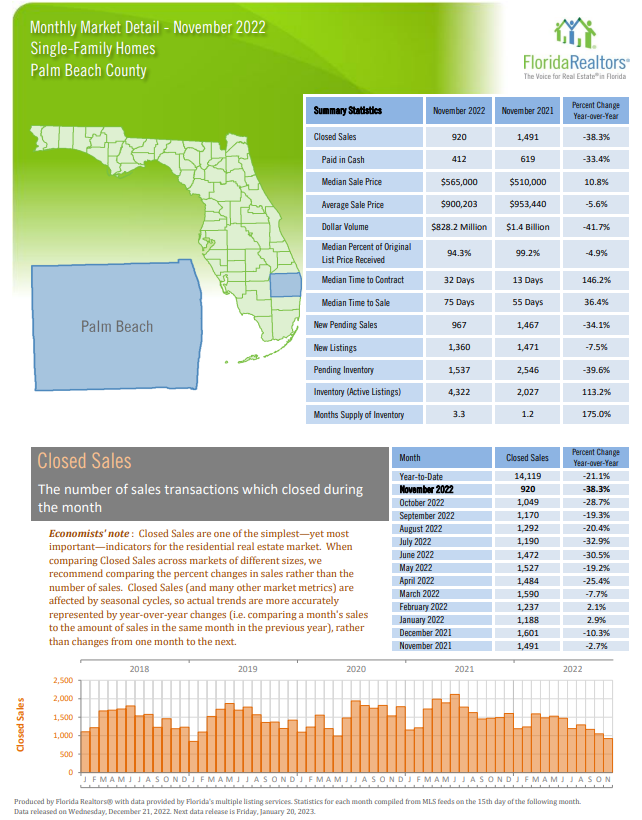

Sales rose in Jan. 2022 and then fell for the next 11 months. Based mainly on rising mortgage rates, 2022 U.S. home sales were down 17.8% year-to-year.

WASHINGTON – Existing home sales retreated for the eleventh consecutive month in December, according to the National Association of Realtors® (NAR). Three of the four major U.S. regions tracked by NAR recorded month-over-month drops, while sales in the West were unchanged. All regions experienced year-over-year declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums, and co-ops – decreased 1.5% from November to a seasonally adjusted annual rate of 4.02 million in December.

Year-over-year, sales sagged 34.0% (down from 6.09 million in December 2021).

“December was another difficult month for buyers who continue to face limited inventory and high mortgage rates,” says NAR Chief Economist Lawrence Yun. “However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.”

Total housing inventory registered at the end of December was 970,000 units, down 13.4% from November but up 10.2% year-to-year (880,000). Unsold inventory sits at a 2.9-month supply at the current sales pace, down from 3.3 months in November but up from 1.7 months in December 2021.

The median existing-home price for all housing types in December was $366,900, a 2.3% increase from December 2021 ($358,800), with prices higher in all four regions. It’s now 130 consecutive months of year-over-year increases, the longest-running streak on record.

“Home prices nationwide are still positive, though mildly,” Yun says. “Markets in roughly half of the country are likely to offer potential buyers discounted prices compared to last year.”

Properties typically remained on the market for 26 days in December, up from 24 days in November and 19 days in December 2021. Of the homes sold in December 2022, 57% were on the market for less than a month.

One out of three December sales went to first-time buyers (31%), up from 28% in November and 30% one year earlier.

All-cash sales accounted for 28% of December’s transactions, up from 26% in November and 23% in December 2021.

“Cash buyers are unaffected by fluctuations in mortgage rates and were able to take advantage of lower prices in some areas,” Yun says.

Individual investors or second-home buyers, who make up many cash sales, purchased 16% of homes in December, up from 14% in November but down from 17% in December 2021.

Distressed sales – foreclosures and short sales – represented 1% of sales in December, virtually unchanged from last month and one year ago.

According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.15% as of January 19. That’s down from 6.33% last week but up from 3.56% one year ago.

Single-family and condo/co-op sales: Single-family home sales declined to a seasonally adjusted annual rate of 3.60 million in December, down 1.1% from 3.64 million in November and 33.5% from the previous year. The median existing single-family home price was $372,700 in December, up 2.0% from December 2021.

Existing condominium and co-op sales were at a seasonally adjusted annual rate of 420,000 units in December, down 4.5% from November and 38.2% from one year ago. The median existing condo price was $317,200 in December, an annual increase of 3.3%.

NAR President Kenny Parcell says Realtors helped millions of Americans amid a market “that experienced some tough headwinds last year. In 2023, we’ll continue to work with legislators and real estate leaders at all levels to address inventory shortages and increase access to homeownership.”

Regional breakdown: Existing-home sales in the Northeast slid 1.9% from November to an annual rate of 520,000 in December, down 28.8% year-to-year. The median price in the Northeast was $391,400, a 1.6% increase from the prior year.

Existing-home sales in the Midwest fell 1.0% from the previous month to an annual rate of 1.01 million in December and down 30.3% from one year ago. The median price in the Midwest was $262,000, up 2.9% year-to-year.

In the South, existing-home sales slipped 2.2% in December month-to-month to an annual rate of 1.80 million, a 33.1% decrease from the previous year. The median price in the South was $337,900, an increase of 3.5% year-to-year.

At an annual rate of 690,000, existing-home sales in the West were unchanged from November but down 43.4% year-to-year. The median price in the West was $557,900, an increase of $200, or less than a tenth of a percent compared to December 2021.

© 2023 Florida Realtors® | Kerry Smith

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Andril Yalanskyl, Getty Images

Andril Yalanskyl, Getty Images